Investment strategies tailored to each client’s unique risk tolerance, liquidity needs, and objectives.

As independent financial advisors, Gilbert Investment Management offers unbiased, customized, investment advising to our clients. This is what separates us from other large big box investment firms. We meet with our clients one-on-one and offer custom consultation to all of our clientele. This ensures a.) our clients get the best possible service and b.) our clients have a real person that is in charge of their investments. We operate with the human element in mind and we believe in order to really understand how our investors invest we have to know our client wants and needs.

We offer both commission and fee-based accounts, as agents or as managers with discretionary authority. Invest with Gilbert Investment Management and control your financial future today.

Clearing and Custody through Pershing LLC

PHONE

(207) 232-8323

LOCATION

Portland

70 Center Street 2nd Floor

Portland, Maine 04101

Boston

20 McKenna Terrace

Suite 304 Boston, MA 02132

Westborough

Westborough, MA 01581

Believe in a better investment strategy.

By knowing our clientele, our customized, personalized, investment strategies are unique to Gilbert Investments and our clients. As financial advisors we are regularly running research processes for our clientele. We gather this data while looking for a very specific profile for their portfolio. Before Gilbert Investments ever considers buying into a stock for our clients we look for the health and performance metrics to make sure this stock fits into our clients portfolio and investment strategies. Read More

We are goal oriented, driven, financial advisors that can deliver results.

With offices in Portland, Maine and Boston, Massachusetts we have worked with many different accounts from big to small and with our credentials we are sure to meet the criteria of any potential investor. We believe that a well-constructed and managed investment portfolio of individual securities is often the best way for most investors to achieve their investment goals. Unlike owning investment products such as mutual funds, annuities, or ETFs, clients can more clearly appreciate and understand the risk and return profile of their investment portfolio. Working together with your advisor, armed with a common sense approach, seasoned research methodology, and transparency is the best way forward.

We have decades of experience.

WIth a deep understanding of the timeless investment wisdom that can preserve and grow your wealth. Our research is proprietary and we manage separate accounts of individual securities. As with anything, you can only get better with experience. We have been in the business of advising clients on their investment portfolios for decades, through all kinds of market environments. Gilbert Investment Management uses the experience and wisdom of the past, combined with the embracing of effective strategies of today to provide our customers with the best service possible.

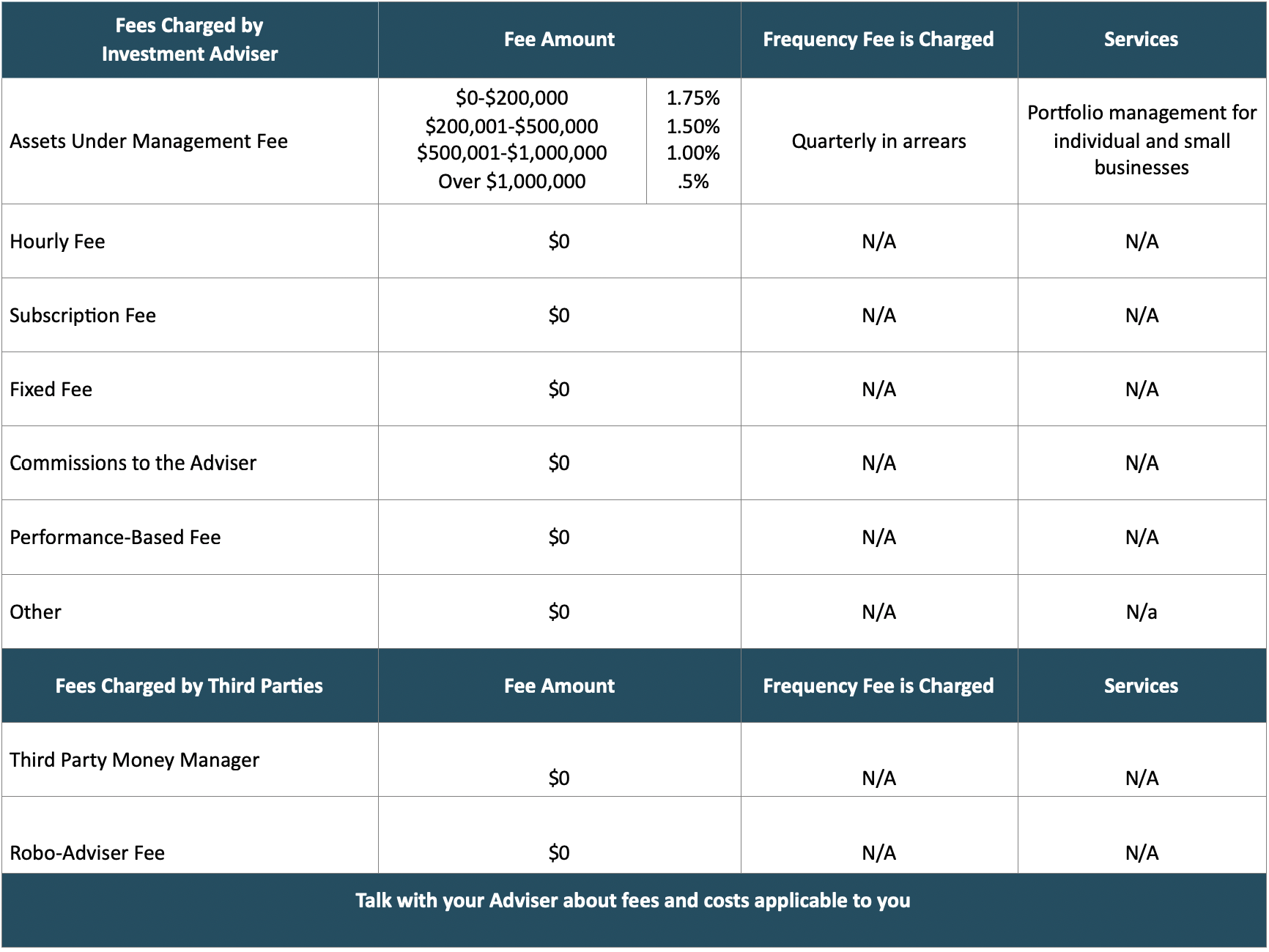

Table of Fees for Services

*FOR MASSACHUSETTS CLIENTS ONLY* Carefully read Item 4 and Item 5 of Form ADV Part 2A (“Brochure”), as these sections of the Brochure contain important details about Gilbert Investment Management, Inc advisory services and fees. A complete explanation of fees and services can be found in the Firm’s Form ADV Part 2A. The fees may not apply to all clients. Fees may be negotiable. The fees below will only apply to you when you request the services listed. Different fees may represent alternative payment options for similar services or combinations of services. Talk with Gilbert Investment Management, Inc about what services are appropriate for you and the fees that will apply.

PART III

Additional fees and costs to discuss with your advisor.

Gilbert Investment Management – The Four Phases of Great Financial Advice

Financial advice is not like any other type of advice. Advice about money is primary; it takes precedence over nearly every other type of advice. It permeates the decisions regarding other crucial life issues such as healthcare or legal matters.

The numeric results of a planning or investment calculation usually cannot provide the kind of information that an investor requires to make sound decisions. Often, only the interpretation of that information by an experienced financial advisor can develop the quantitative information into a set of conclusions, and ultimately towards truly personalized financial advice. The final goal is to provide advice to a client after many years of working together, that’s when the financial advice has the most positive impact.

I like to think of this development of financial advice as ‘The Four Phases of Financial Advice’, as follows:

Phase 1: the number or investment idea, calculation result, tip, or research

Phase 2: to convey that numerical information content in understandable, plain language to the non-expert

Phase 3: to provide that quantitative information in a personalized way

Phase 4: to deliver that information in a personalized way, after an extended relationship with the recipient

The best financial advice is delivered most effectively by an experienced advisor, with a long-duration relationship with the client.

Investing.

Investing begins with, and requires, the liquid wealth that remains after all other costs are covered to support an individual’s lifestyle. Just like many things, this amount is different for each of us. As a result, any investment program or plan must be personalized to the individual’s circumstances.

A financial advisor adds value to the process by helping you understand your current position; your net income, wealth and long-term goals and plans. The advisor helps you clarify where you are now, and guides your decisions on a regular basis, in anticipation of the future.

Planning is crucial to a healthy financial life. In fact, planning is not unique to finance; most things in life benefit from planning. So, planning is very important, but only if you have the best fitting partner to help you. Planning takes many difference forms in the marketplace, and its important to know the alternatives.

The way you build wealth is by saving, and investing that savings effectively. Saving alone will not provide enough wealth for most people to meet their obligations later in life. A financial advisor provides his or her investment acumen and expertise to help a client choose from the thousands of investment options, techniques, and vehicles available to help you achieve your goals.

The Difference.

At Gilbert investment Management, we understand that sound financial advice and planning is not a one-time effort, but an on-going approach and process. This approach provides for new information to inform the advice and the plan, and tailors your goals throughout your life. We set up a routine to check in with our clients, at their convenience, to keep the advice and the plan on-target.

We recommend that clients build a team of advisors; a financial advisor, an accountant for tax filing and tax questions, and an attorney, for wills and trusts. Finally, a good relationship with an insurance broker and a mortgage broker is important. Many firms offer all of these professionals together, under one roof, but we believe that it is better to keep them separate. That way, you have more options and the net result is more suitable advice.

At GIM, we focus on separate account management of individual securities, as well as planning and general financial advisory. A well-managed, personalized, fee-only investment account, may be the best approach to build your wealth for the long-term. It provides you the most options, the greatest flexibility and transparency, and in most circumstances, the most liquid way to conserve and grow your wealth. Investing in a portfolio of individual securities, carefully- selected and appropriate for the client’s risk tolerances and goals, may be the most efficient and successful approach.

Along with client-focused financial advisory and planning, stock research is a passion at Gilbert Investment Management. We have developed our own proprietary research methods. Generally, we look for a combination of quantitative and qualitative factors that help you to protect your capital, and grow for the long-term. Most of our stocks vary in market capitalization and industry sector, but share growth profiles at attractive prices.

Client Focus.

As Fee-Only financial advisors, we are here, on the ‘same side of the table with you’, to help guide your investment program and plan. The more we get to know our clients, the more effective we can be. Our clients are given advice we would share with our own family members. There is no benefit to be anything but completely transparent about what we think about your portfolio, your unique circumstances, and your plan. Unlike many institutional Wall Street money managers, we see ourselves as your local community advisor, riding along with the market with you, not in opposition to you. In the end, the market is driven primarily by psychology; it is a very ‘human’ business. Despite the use of algorithmic trading and artificial intelligence in finance, the prices of stocks and bonds begin and end with the basic economic drivers of supply and demand. Like running shoes merchandised at a sporting goods store, stocks and bonds are similarly merchandised and marketed, and susceptible to the passions and trends of the marketplace. These trends can easily overwhelm any purely quantitative, clinical analysis of value. A wise investor and advisor knows this.

DONALD E. GILBERT CO-FOunder

Ted has been actively managing fee-based separate account portfolios valuing between $10,000 and $2,000,000 for individual investors since 2006. He has been in the financial services industry, including three years in New York, since 1996. He has worked as a data and stock surveillance analyst at Carson Group, as an equity analyst and trader at Cape Cod Bank & Trust, and Portfolio Manager at Dow Investment Group.

Ted lives in Westborough, Massachusetts with his wife and children and travels regularly to the Gilbert Investment Management offices in Boston and Portland.

In addition to a number of athletic and outdoor activities, Ted has a passion for helping the investing public learn more about personal finance and investing. He hosts STOCKTAILS MeetUp events in multiple locations.

WAYNE SCHAAB

Wayne has been in the investment business for over 20 years. After working for a major national brokerage firm, he concluded that it was in the best interest of his clients to work with an independent brokerage firm. His specialty is the construction of customized portfolios with a focus on portfolio income, utilizing extensive knowledge of both fixed income and equity securities.

As a Canadian native, Wayne attended the University of British Columbia before playing in the professional hockey leagues for 13 years. He enjoyed particular success with the Maine Mariners, becoming a local celebrity. Notably, Wayne holds the distinction of being the first Maine Mariner to have had his jersey retired.

Wayne and his wife Cindy have three children and live in South Portland.

WHO WE ARE

Who is Gilbert Investment Management?

Ted Gilbert and Wayne Schaab have decades of experience advising individual investors about their finances. Ted and Wayne have a deep understanding of the role of investments in the lives of their clients and their long term plans. Everyone has an emotional response to money, it’s a fact of life, and we at GIM know that so much of being a helpful guide is to understand our clients on this emotional level. To be helpful, to be effective, a good advisor needs to have a firm understanding of both the emotional side of investing, and the obvious hard facts and science of successful investing. Ted and Wayne know that before any of this good advising takes place, trust in us must be felt by our clients. We get there by being as transparent, honest and up-front about the circumstances, costs, and realities of investing as possible. We trust in our investing acumen, that we only achieved that through years of determined hard work and actual experience managing accounts day after day. Therefore, you can trust that what we suggest to you is our very best. On a more personal level, Wayne and Ted love Maine and are dedicated to the people and community of Maine. Our connection to Maine, and to New England in general, adds to the connection we have with our clients.

What is Gilbert Investment Management?

Gilbert Investment Management Inc. (GIM), is a fee-based state-registered Registered Investment Advisory firm (RIA). We offer both non-discretionary and discretionary, separately-managed investment accounts to individual investors. Our client accounts hold individual positions of stocks and bonds, and mutual funds or ETFs or even LP’s (to a lesser degree). We customize each client account to the individual needs of the client. On a regular basis, we are monitoring the holdings of these accounts, and the broader performance. We manage our client accounts to a fiduciary standard which means to the highest level of transparency and trust. Our primary custodian for accounts is Bank of New York Mellon, and we also offer Interactive Brokers. This means there is total separation between the manager of your account (GIM), and the custodian of your account, other than to make trades.

Where is Gilbert Investment Management?

Gilbert Investment Management Inc. has offices at 70 Center Street, Portland, Maine 04101 and 20 McKenna Terrace, Boston, Massachusetts 02132. We work with clients throughout New England, and the U.S. We are available for in-person meetings nearly anywhere it is reasonably convenient for both client and advisor.

Why Gilbert Investment Management?

There is broad and varied landscape of advisory firm offerings available to most individual investors. Nearly all of them are populated by pleasant, smart and hard-working people. I would make an educated guess that 95% or so of these brokerage firms, banks, investment firms, insurance shops offer a ‘paint by the numbers’ investment advisory approach to clients. That is, they use the ‘when in doubt, pick one of everything’ approach which means they over-diversify your investment portfolio to minimize risk – mostly their risk of being wrong. Essentially, they buy for you the entire market (both a big swath of the equity and bond market), and then just hope your account keeps up with the market. There is nothing inherently wrong with this approach. It just means most advisors are not confident enough in their skill as investment advisors to do anything different for the risk of making a mistake. Without much effort going to the investment side of their business, instead these advisors spend 95% of their time and effort on keeping you happy through superb client service, sales efforts, and marketing efforts. At GIM, we also highly value the client experience, and no doubt, we want you to at least do as well as the markets into which we invest your hard-earned capital. But, we believe that a well-managed stock and bond portfolio can meet that threshold, and possibly exceed it. Our core expertise is the hands on effort to find opportunities for our clients where the return vs risk potential may be more favorable.

CHOOSING THE RIGHT FINANCIAL ADVISORS IN PORTLAND, MAINE

Gilbert Investment Management is a boutique investment firm based in Portland Maine. Our financial advisors provide the care and direction needed to hit the financial goals our clients are looking for. Our speciality is the fee-based management of separate accounts for individual investors. Having been in the financial advisory industry since 1996, we know that investors have many different money management options available. What makes Gilbert Investment Management unique is that we emphasize the benefits of portfolios of individual securities, rather than a pain by the numbers asset allocation strategy. In addition, our advice is 100% independent and unbiased. We give you our best financial advice, as if you were a member of our family.

Many financial advisors talk about how many decades they have been in business, as if that alone makes for sound financial advice. Unfortunately, often those older firms, made up of older advisors, are stuck in their ways, and distracted by their own history. Come work with a firm with fresh ideas and beneficial strategic investment practices. Come join the Gilbert Investment Management family.

clearing & custody

Learn more about Bank of New York Mellon, Pershing Clearing, and Excess Account Protection

Additional services

Find out about our lending and cash management solutions, view account forms, and access your online account.